Temenos Announces Q1-25 Results; Solid Growth in ARR, EBIT and FCF

Reconfirming FY-25 guidance and providing Q2-25 growth outlook

Q1-25 summary (proforma, excluding Multifonds)

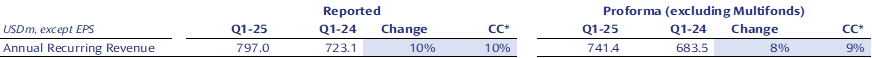

• Q1-25 ARR of USD 741m up 9% y-o-y c.c.

• Strong high-teens growth in software licensing largely compensated for anticipated downsell from large SaaS Buy Now Pay Later (BNPL) customer

• Q1-25 non-IFRS subscription and SaaS down -2% c.c.; some push out around deal signings at quarter-end given increased macroeconomic uncertainty

• Q1-25 non-IFRS maintenance up 11% c.c.

• Q1-25 non-IFRS EBIT up 8% c.c. with 1% point of margin expansion

• Q1-25 non-IFRS EPS up 17%

• Q1-25 free cash flow of USD 49m, up 12%

• Good start to Q2-25 with a number of deals already signed

• Q2-25 indicative growth rates for non-IFRS subscription and SaaS growth of 6-10% and ARR growth of at least 10% excluding Multifonds

• FY-25 guidance reconfirmed (non-IFRS, constant currency, excluding Multifonds), while recognizing increased macroeconomic uncertainty; ARR growth of at least 12%, Subscription and SaaS growth of 5-7%, EBIT growth of at least 5%, EPS growth of 7-9% reported and free cash flow growth of at least 12% reported

• FY-28 targets reconfirmed (non-IFRS, constant currency, excluding Multifonds) with ARR to reach more than USD 1.2bn, EBIT to reach c.USD 450m and Free Cash Flow to reach c.USD 400m

• Share buyback of up to CHF 250m announced today, to commence on April 28, 2025 and close by December 30, 2025 at the latest; shares to be proposed for cancellation at the 2026 AGM

Ad hoc announcement pursuant to Art. 53 LR

GRAND-LANCY, Switzerland, April 22, 2025 – Temenos AG (SIX: TEMN), a global leader in banking technology, today announces its first quarter 2025 results.

Annual Recurring Revenue (ARR)

Reported income statement

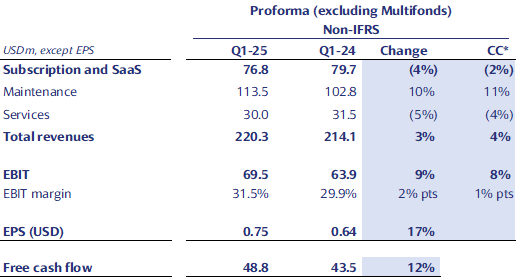

Proforma income statement and free cash flow excluding Multifonds

Q1-25 business update

- Sales environment remained stable until last two weeks of the quarter, which saw some push outs of deal signings; deals are expected to be signed in Q2-25

- Solid growth in ARR and maintenance providing visibility on future revenue and free cash flow

- Strong high-teens growth in software licensing largely compensated for anticipated downsell from large SaaS BNPL customer

- Continued execution of targeted investments across the business

- Strong growth in profitability driven by excellent cost control and progress on cost savings initiatives

- Continued execution of US strategy with opening of sizeable innovation hub in Florida

- Simplification of product and technology organization and portfolio also progressing well, in line with strategic plan

- Strength of balance sheet and free cash flow generation supports share buyback of up to CHF 250m (press release available here); shares to be proposed for cancellation at the 2026 AGM

Q1-25 financial summary (non-IFRS, proforma excluding Multifonds except leverage)

- ARR of USD 741.4m, up 9% c.c.

- Non-IFRS subscription and SaaS of USD 76.8m. down 2% c.c.

- Non IFRS maintenance revenue of USD 113.5m, up 11% c.c.

- Non-IFRS total revenue of USD 220.3m, up 4% c.c.

- Non-IFRS EBIT of USD 69.5m, up 8% c.c.

- Q1-25 non-IFRS EBIT margin of 31.5%, up 1% pt c.c.

- Non-IFRS EPS of USD 0.75, up 17% reported

- Q1-25 free cash flow of USD 48.8m, up 12% y-o-y

- Leverage at 1.3x at end of Q1-25

Commenting on the results, Temenos CEO Jean-Pierre Brulard said:

”In the first quarter, our good underlying performance was affected by the anticipated downsell from a large SaaS BNPL client and some push out of deal signings toward the end of the quarter, given increased macroeconomic uncertainty. We delivered high teens growth in software licensing driven mainly by subscription licenses and we are confident the delayed deals will be signed in Q2. We won a number of new SaaS core banking logos in Western Europe and North America in the quarter, demonstrating the strength of our SaaS and cloud capabilities and competitive positioning in the market. We also had a significant number of go-lives in the quarter as we continue to invest in customer lifecycle.

We continue to make excellent progress on our strategic roadmap, with the opening of our innovation hub in Florida to serve our US requirements as well as the global market. We have also pressed ahead at speed with the simplification of our global product and technology organization and our product portfolio to align with our strategic priorities. Furthermore, we are confident the business will continue to perform well in the current environment. Digital transformation is not discretionary and banks have a mandate to renovate their IT real estate to lower TCO and to enable their businesses to scale efficiently.”

Commenting on the proforma results (excluding Multifonds), Temenos CFO Takis Spiliopoulos said:

“We had solid growth in ARR in the quarter, up 9% in constant currency, driven by growth in subscription licenses and our maintenance revenue which again grew double-digit, benefiting from a good level of premium maintenance signings. With the push out of a number of deals into the second quarter, the high teens growth in software licensing was not sufficient to offset the anticipated decline in SaaS revenue.

We maintained excellent control of our cost base in the quarter which was marginally up year-on-year in constant currency, benefiting from our sustained progress and solid execution on cost savings initiatives. Non-IFRS EBIT grew 8% in the quarter whilst we continued to execute on our targeted investments as planned.

We generated USD 48.8m of free cash flow, increasing 12% year-on-year, and ended the quarter with leverage at 1.3x net debt to non-IFRS EBITDA, including the Multifonds balance sheet impact, which is well within our target operating leverage of 1.0 to 1.5x. As a reminder, the sale of Multifonds is expected to close in the second quarter.

We have exceptionally given indicative growth rates for Q2-25, given the current market volatility, with non-IFRS subscription and SaaS expected to grow 6-10% and ARR to grow at least 10%. We have reconfirmed our guidance for FY-25, while recognizing the increased levels of macroeconomic uncertainty.

Lastly, given the strength of our balance sheet and free cash flow, we have announced a share buyback of up to CHF 250m which will commence on April 28, 2025. The shares will be proposed for cancellation at the 2026 AGM”

Revenue

Reported IFRS and non-IFRS revenue was USD 232.2m for the quarter, an increase of 1% vs. Q1-24

Proforma non-IFRS revenue (excluding Multifonds) was USD 220.3m for the quarter, an increase of 3% vs. Q1-24

Reported IFRS and non-IFRS subscription and SaaS revenue for the quarter was USD 80.2m, a decrease of 5% vs. Q1-24.

Proforma non-IFRS subscription and SaaS revenue (excluding Multifonds) for the quarter was USD 76.8m, a decrease of 4% vs. Q1-24.

EBIT

Reported IFRS EBIT was USD 40.1m for the quarter, a decrease of 14% vs. Q1-24.

Reported non-IFRS EBIT was USD 75.8m for the quarter, an increase of 4% vs. Q1-24.

Proforma non-IFRS EBIT (excluding Multifonds) was USD 69.5m for the quarter, an increase of 9% vs. Q1-24.

Earnings per share (EPS)

Reported IFRS EPS was USD 0.40 for the quarter, a decrease of 9% vs. Q1-24.

Reported non-IFRS EPS was USD 0.81 for the quarter, an increase of 11%.

Proforma non-IFRS EPS (excluding Multifonds) was USD 0.75 for the quarter, an increase of 17% vs. Q1-24.

Cash flow

USD 48.8m of free cash flow (excluding Multifonds) was generated in the quarter, an increase of 12% vs. Q1-24.

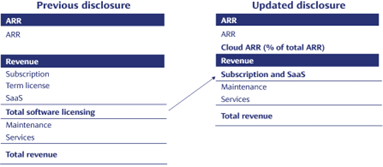

Revenue line items and new cloud ARR disclosure

Temenos introduced new annual disclosure of cloud ARR at the time of its Q4-24 results announcement in February 2025, to provide transparency on the growth in cloud adoption. Its revenue disclosure was also updated to reflect changes in customer demand and industry best practice, with increasing use of hybrid and public cloud. ‘Total software licensing’ was renamed as ‘subscription and SaaS’ to bring disclosure in line with leading global software players. ‘Subscription and SaaS’ comprises subscription, term license and SaaS revenue. Term license is expected to continue declining to around USD 20-30m p.a. steady state.

FY-25 non-IFRS guidance reiterated

The guidance for FY-25 is non-IFRS and in constant currencies, except for EPS and FCF which are reported. The guidance excludes any contribution from Multifonds. Free cash includes IFRS 16 leases and interest costs.

FY-25 guidance reiterated

- ARR growth of at least 12%

- Subscription and SaaS growth of 5-7%

- EBIT growth of at least 5%

- EPS growth of 7-9% reported

- FCF growth of at least 12% reported

The Company has also assumed the following for FY-25 guidance:

- FY-25 tax rate expected to be between 15-17%, benefiting from one off tax impact of c.USD 15m from prior years; normalized tax rate of 19-21%

Currency assumptions for FY-25 guidance

In preparing the FY-25 guidance, the Company has assumed the following:

- EUR to USD exchange rate of 1.09;

- GBP to USD exchange rate of 1.30; and

- USD to CHF exchange rate of 0.86

FY-28 targets

FY-28 targets exclude contribution from Multifonds. Free cash flow includes IFRS 16 leases and interest costs.

- ARR of at least USD 1.2bn

- EBIT of c. USD 450m

- FCF of c. USD 400m

The guidance provided above and other statements about Temenos’ expectations, plans and prospects in this press release constitute forward-looking financial information and represent the Company’s current view and estimates as of April 22, 2025. We anticipate that subsequent events and developments may cause the Company’s guidance and estimates to change. Future events are inherently difficult to predict. Accordingly, actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors. More information about factors that potentially could affect the Company’s financial results is included in its annual report available on the Company’s website.

Conference call and webcast

At 18.30 CET / 17.30 GMT / 12.30 EST today, April 22, 2025, Jean-Pierre Brulard, CEO, and Takis Spiliopoulos, CFO, will host a webcast to present the results and offer an update on the business outlook. The webcast can be accessed through the following link:

Please use the webcast in the first instance to avoid delays in joining the call. For those who cannot access the webcast, the following dial-in details can be used as an alternative. Please dial in 15 minutes before the call commences.

Switzerland / Europe: + 41 (0) 58 310 50 00

United Kingdom: + 44 (0) 207 107 06 13

United States: + 1 (1) 631 570 56 13

Non-IFRS financial Information

Readers are cautioned that the supplemental non-IFRS information presented in this press release is subject to inherent limitations. It is not based on any comprehensive set of accounting rules or principles and should not be considered as a substitute for IFRS measurements. Also, the Company’s supplemental non-IFRS financial information may not be comparable to similarly titled non-IFRS measures used by other companies. The Company’s non-IFRS figures exclude share-based payments and related social charges costs, any deferred revenue write-down resulting from acquisitions, discontinued activities that do not qualify as such under IFRS, gain/loss from business disposals, acquisition/investment/carve out related charges such as financing costs, advisory fees and integration costs and fair value changes on investments, charges as a result of the amortization of acquired intangibles, costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and adjustments made to reflect the associated tax charge relating to the above items.

Below are the accounting elements not included in the FY-25 non-IFRS guidance.

- FY-25 estimated share-based payments and related social charges of c.5% of revenue

- FY-25 estimated amortisation of acquired intangibles of USD 45m

- FY-25 estimated restructuring/M&A related costs of USD 35m

Investor & Media Contacts

Investors

Adam Snyder

Head of Investor Relations, Temenos

Email: [email protected]

+44 207 423 3945

International media

Conor McClafferty

FGS Global on belhalf of Temenos

[email protected]

+44 7920 087 914

Swiss media

Martin Meier-Pfister

IRF on belhalf of Temenos

[email protected]

+41 43 244 81 40